Since negative nominal rates and a higher inflation target both serve to reduce the lower negative bound on the real interest rate achievable by monetary policy they are to some extent substitutes. Governments imposing negative nominal interest rates are attempting to.

Compete with private banks in the lending market.

. Discourage the use of banks. Negative nominal rates in times of inflation or price stability do seem associated with economic malaisenot disaster but slow growth and retarded innovationand long-term unsustainable situations that no one is willing to address. So what is causing the negative nominal interest rates on these government bonds and more importantly.

Suppose the federal government had budget deficits of 40 billion in year 1 and 50 billion in year 2 but had budget surpluses of 20. Level of total spending. Discourage consumption and encourage saving.

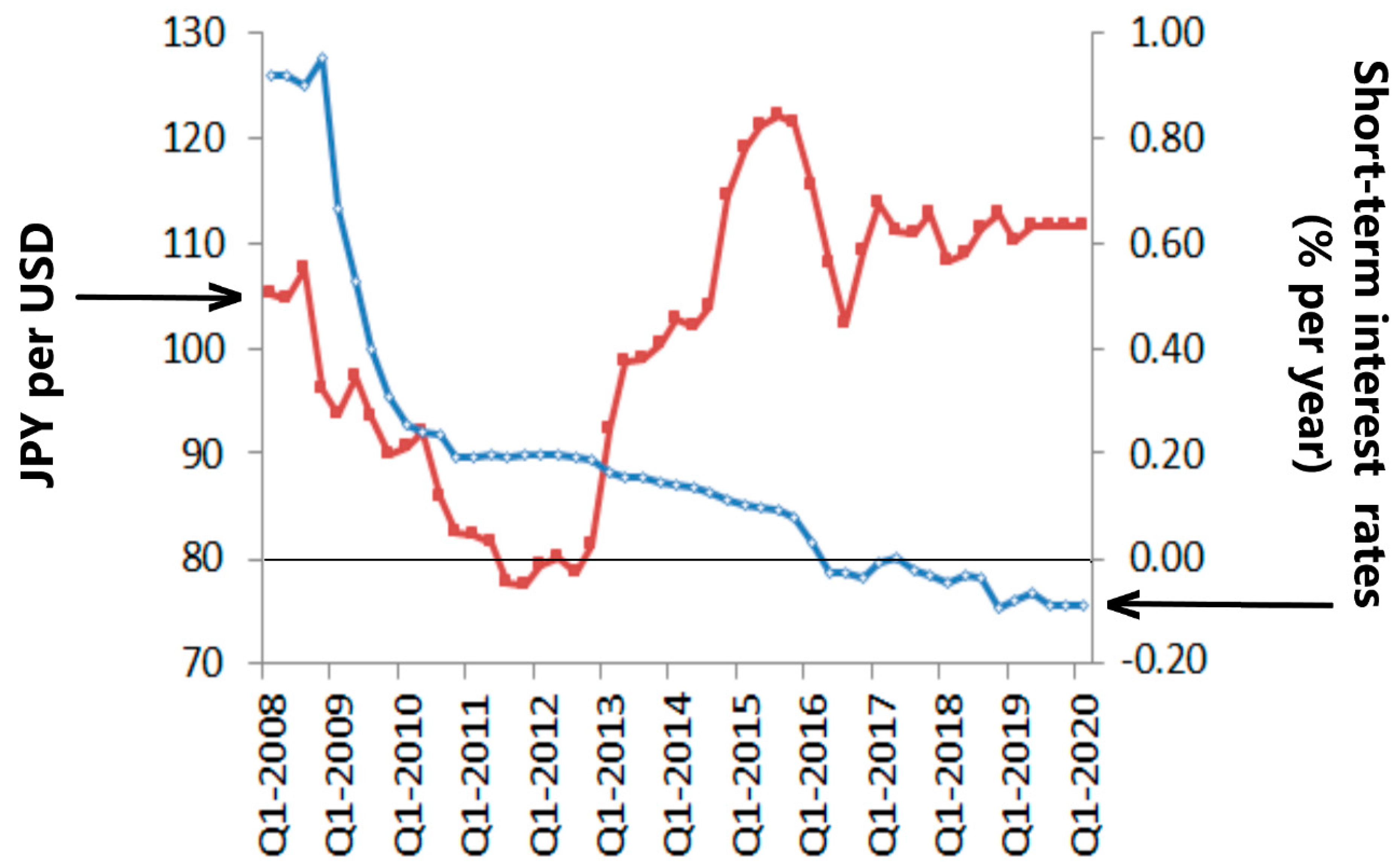

The second reason for adopting low-interest rates is much more practical and far. Compete with private banks in the lending market. In their implementation a negative interest rate is charged only on the portion of the banks reserves sight deposit balance at the SNB that exceeds a.

A negative nominal interest rate means that there is some massive financial crisis in which people are bailing cash. Cdiscourage consumption and encourage saving. 1 Figure 2 shows negative rates have spilled over into corporate and.

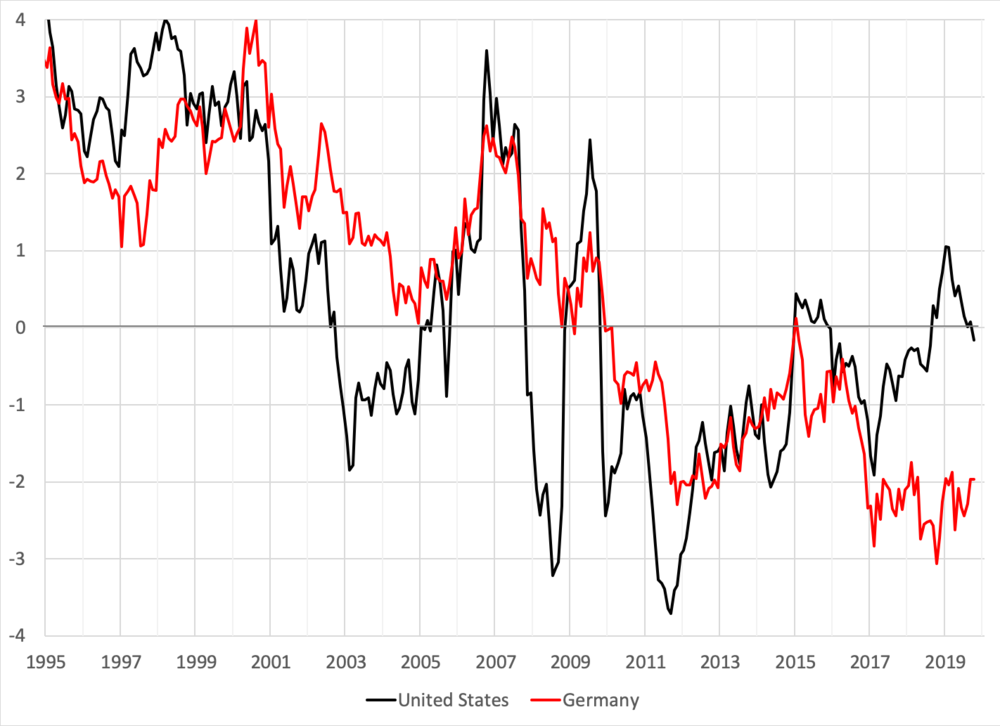

Interest rates are now negative below zero for a growing number of borrowers mainly in the financial markets. The possibility of negative nominal interest rates. Governments imposing negative nominal interest rates are attempting to encourage consumption by discouraging saving.

Bcompete with private banks in the lending market. Compete with private banks in the lending market. Governments imposing negative nominal interest rates are attempting to discourage the use of banks.

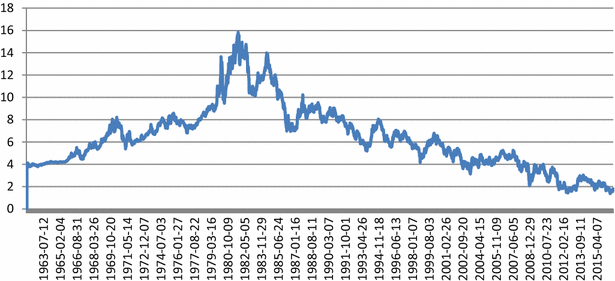

Governments imposing negative nominal interest rates are attempting to encourage consumption by discouraging saving Unemployment rates in the United States from 2005 to 2015 were in the range of 64 percent. Discourage consumption and encourage saving. Encourage consumption by discouraging saving.

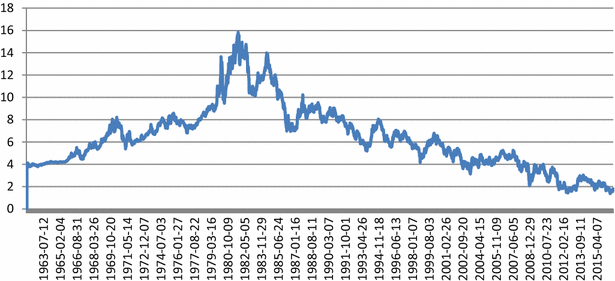

Dencourage consumption by discouraging saving. If the real interest rate and the nominal interest rate are both negative and equal to each other then the inflation premium is zero. Yet as of mid-2016 the government bonds reflecting about one-third of global economy had negative nominal interest rates the Euro area Japan Sweden Denmark and Switzerland.

Several including the European Central Bank and the central banks of Denmark Japan Sweden and Switzerland have started experimenting with negative interest rates essentially making banks pay to park their excess cash at the central bank. Negative deposit rates have many of the same effects as cuts in positive interest rates. It means in effect they are.

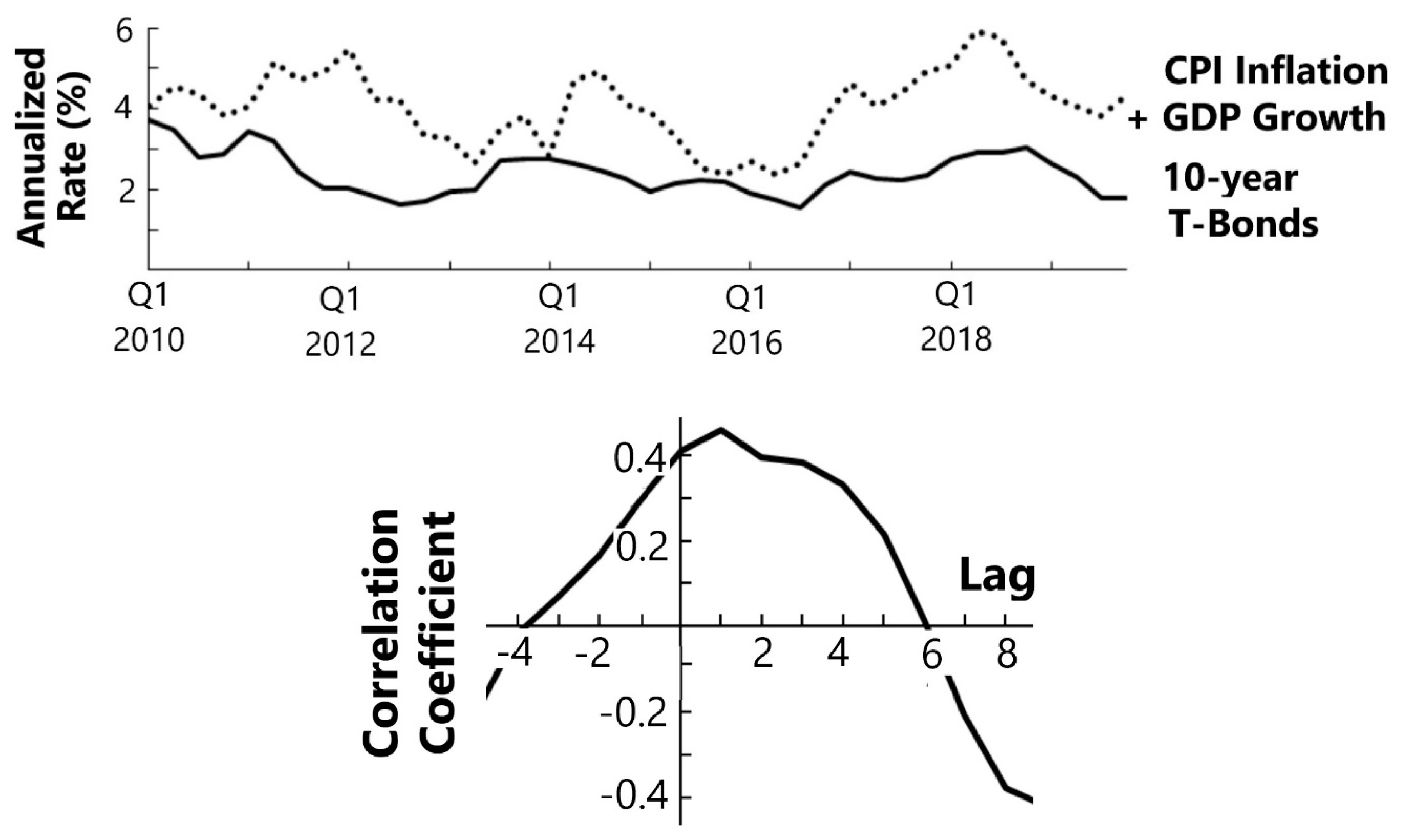

QUESTION 13 Governments imposing negative nominal interest rates are attempting to discourage the use of banks. Discourage consumption and encourage saving. As long as all interest rates move in tandem including the rate of return on paper currency economic theory suggests no important difference between interest rate changes in the positive region and interest rate changes in the negative regionIndeed in standard models only the real interest rate and spreads between real interest rates matter.

Bech and Malkhozov 2016. Negative interest rate policy NIRP is a last-ditch attempt to generate spending investment and modest inflation. Deflation is bad and negative interest rates should help fightor at least not supportthe deflation.

Governments imposing negative nominal interest rates are attempting to Encourage consumption by discouraging saving. This was not caused by nominally negative interest rates but rather by the fact that contractual nominal interest rates were lower than the rate of inflation. The answer is yes but with a caveat.

Governments imposing negative nominal interest rates are attempting to encourage consumption by discouraging saving. It is possible to have negative nominal interest rates and this happened immediately after Lehman when interest rates on short. Governments imposing negative nominal interest rates are attempting to A.

The SNBs negative rate policy imposes such a charge to banks for excess paper currency withdrawals. And Arteta et al 2016. A concern about negative nominal interest rates is that they will encourage more saving by people trying to compensate for the.

Governments imposing negative nominal interest rates are attempting to Adiscourage the use of banks. With negative interest rates in play fiscal policy can focus on the long run and getting good deals for taxpayers rather than aggregate demand stimulus. Encourage consumption by discouraging saving.

Banks tend to make more and riskier loans or buy longer-term securities thereby stimulating the economy Jobst and Lin 2016. Encourage consumption by discouraging saving. Governments imposing negative nominal interest rates are attempting to Negative interest rate policy NIRP is a last-ditch attempt to generate spending Written By laurencebalmer5774 March 31 2022 Add Comment Edit.

If the preference for current consumption. Wages are flexible upward but sticky downward. Turning to the question at hand is it possible for nominal interest rates to be negative based upon fundamentals.

Put simply if your contract with the bank stipulated for instance a 2 annual rate on your deposit and the inflation rate reached 4 in that year youd have incurred a real loss.

Jrfm Free Full Text Negative Interest Rates Html

Negative Nominal Interest Rates A Primer Money Banking And Financial Markets

Jrfm Free Full Text Negative Interest Rates Html

Negative Interest Rates Causes And Consequences Springerlink

If The Real Interest Rate And The Nominal Interest Rate Are Both Negative And Course Hero

0 comments

Post a Comment